If you are working on the clean energy transition but not also deeply engaged in critical minerals production, you are not really fixing the problem. That’s the message I took from the Chatham House rules session hosted by the Center for Strategic and International Studies.

Similar to what’s happening with solar products, China dominates large segments of the critical minerals supply chain, by mining, processing, and or otherwise controlling the markets. Simultaneously, the United States failed to take steps to secure supply chains early enough, and there is no meaningful domestic production of many key minerals.

“The supply chain was wired in a way that we were OK with,” one of the speakers said. We favored a global supply chain that was wired in favor of cheap and dirty energy, political expediency, and low prices—which tilted the entire market toward China, the speaker added.

Now, a bit late in the game, the U.S. is refocusing to emphasize reshoring—attempting to develop mining, processing, and manufacturing here at home.

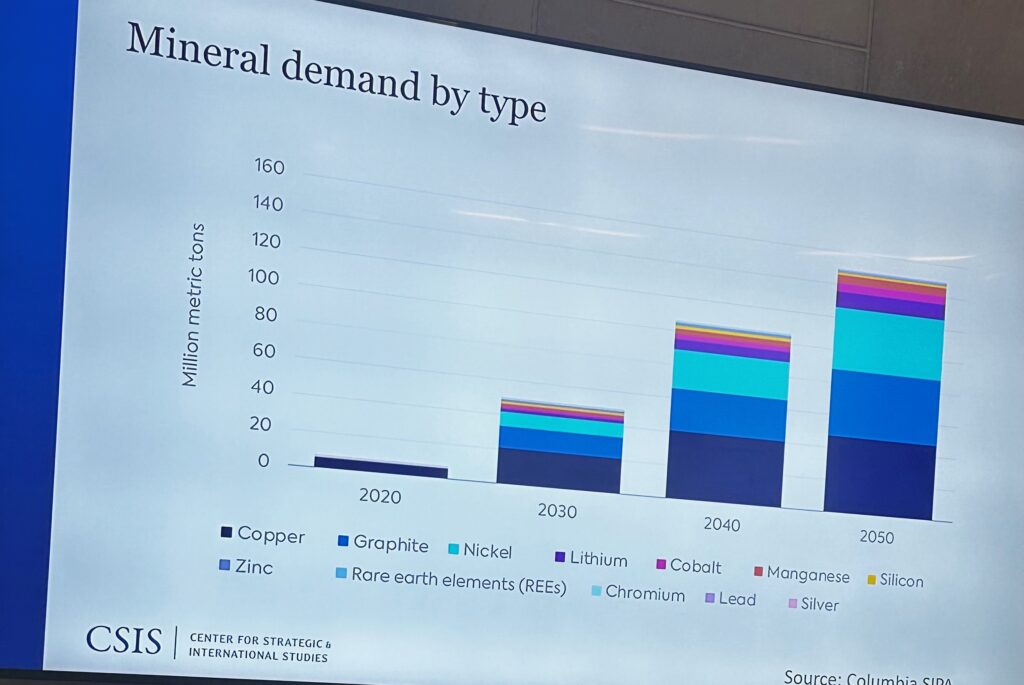

The world now sees massive demand ahead for minerals used in a wide array of vital applications, including the military, energy, consumer products, and advanced technology. With apologies for my photography, see the chart below showing the escalating demand for minerals. The national security risks are staring us in the face.

Notwithstanding unfavorable market conditions, how many communities in the U.S. are now going to welcome massive, polluting and highly complex mining operations for minerals we have not produced in decades, if ever?

Under Chatham House rules, you may write what was said, you just can’t say who said it. Suffice it to say, the presenters were well informed and balanced, many in the audience were subject matter experts in academia or industry and the three-hour session flew by.

The panel’s conclusion? We can never go back to protectionist policies where we or our allies can produce everything we need. But we must establish balance in our supply chains, where we are not completely dependent on China. The goal is market dispersion, not U.S. market dominance, a speaker said.

Still, I left feeling that the solutions are aspirational, and the problems intractable.

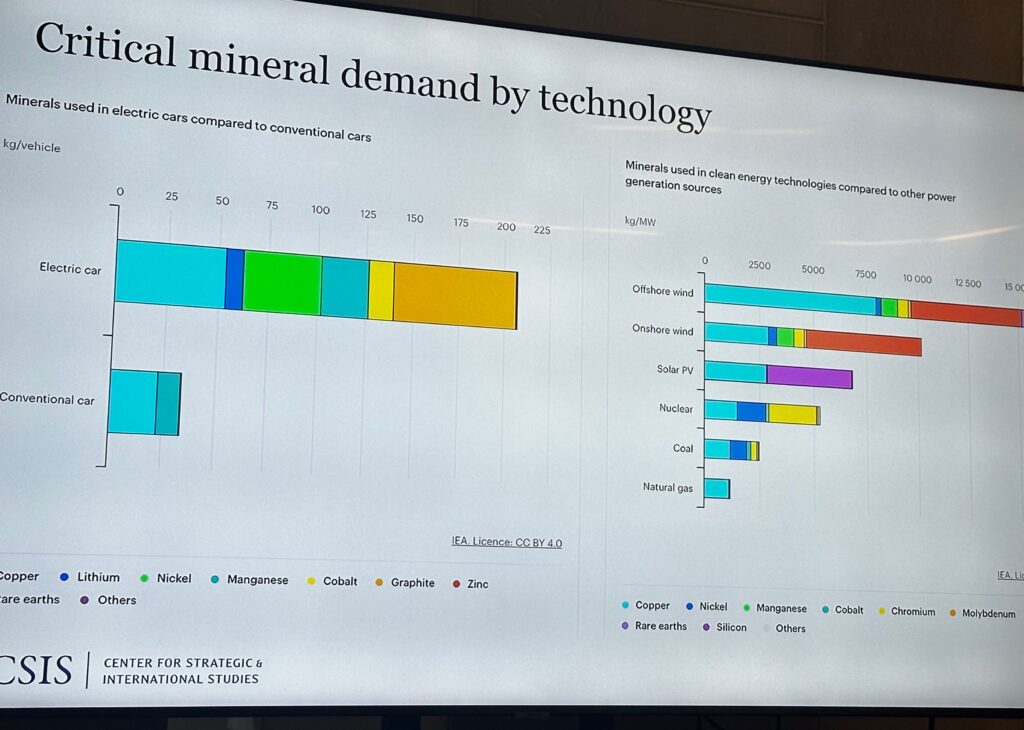

The slide below, “Critical mineral demand by technology,” shows the minerals used for electric vehicles, which will be the dominant vehicle technology in 2050. The slide also shows the critical minerals needed for all power sources. I did not know wind used that much zinc (in red), or that photovoltaic solar used so much copper.

Speakers underscored the fact that U.S. markets for critical minerals have faltered because it’s hard to compete, for example, with cheap cobalt from the Congo or nickel from Russia and Singapore. Those factors help reinforce China’s grip on the markets generally. “China has a decades-long advantage over us,” a speaker said.

Even in the face of abusive labor conditions, questionable trade policies and environmental degradation, low prices still rule. And the additional cost of domestic mining, processing and other supply chain needs effectively have nullified the U.S. market.

The people with deep knowledge of this landscape did offer some closing thoughts:

- We can probably solve some of the economic and technical issues.

- We may have to think of China like we think of OPEC. “We are not going to exclude China from world or U.S. supply chains.”

- The world needs more transparent price, supply, and market signals and more reliable data.

- The U.S. controlled fossil fuel commerce, defending shipping channels and protecting world oil supplies by going to war if necessary. We have not helped secure the resources needed for the new energy economy, and we need some vision to claim leadership.

I personally am fascinated by the need for mineral development as it relates to energy. The issues are complex and may not lend themselves to memes, but if you need someone with deep experience in energy and climate communications to write or help manage your communications or public affairs efforts with clarity, hit me up at [email protected].

Drag